Quick Summary: With AI at its core, banking is transforming into a more intuitive, secure, and efficient domain. This technology is setting new benchmarks for operational excellence and redefining customer interactions. This article delves into the key applications of AI, the challenges financial institutions face in adopting these advancements, and the emerging trends that promise to revolutionize the future of the financial sector.

Introduction

Industries worldwide are experiencing a significant transformation due to Artificial Intelligence, and banking is included in this shift. Banks increasingly turn to AI in the quest for efficiency, customer-centricity, and technological relevance.

According to a Business Insider report on AI in Banking, approximately 80% of banks recognize the substantial advantages AI offers. The impact on financial services is undeniable. From enhancing customer interactions to streamlining operations, AI is reshaping the banking landscape, setting a new standard for innovation and responsiveness.

In this article, we’ll explore AI's core applications in banking, examining its benefits, challenges, and real-world examples that illustrate its transformative impact on the sector.

Key Applications for AI in Banking

From reshaping customer support to refining risk assessments, AI is unlocking new possibilities across the banking landscape. Below, we dive into how financial institutions are integrating AI to tackle complex challenges and meet evolving customer expectations in a smarter, more adaptable way.

1. Cybersecurity and Fraud Detection

Handling millions of transactions daily, banks are constantly under pressure to detect fraud and defend against digital threats. AI steps in as a vigilant guardian, analyzing patterns within vast seas of data, spotting unusual behaviour that could signal fraudulent activity, and revealing hidden vulnerabilities before they’re exploited.

Through automated monitoring, AI allows banks to stay one step ahead, tackling potential risks as they emerge. Its continuous, intelligent watch not only fends off cyber threats but also reassures customers that their information is shielded by cutting-edge technology. This dynamic approach to security fosters trust as banks can now deliver safer, smarter banking environments while meeting stringent regulatory standards.

2. Regulatory Compliance

Navigating strict regulatory standards is a continuous challenge for banks, often requiring extensive resources. AI enhances compliance efforts by utilizing natural language processing (NLP) to analyze and adapt to evolving regulations. This reduces reliance on manual methods and improves overall accuracy. AI doesn’t replace compliance analysts; rather, it complements their work by making processes faster and more streamlined. With this technology, banks are better equipped to handle changing regulations efficiently, freeing compliance teams to focus on strategic priorities.

3. Chatbots and Virtual Assistants

AI-driven chatbots are enhancing the banking experience by addressing common customer inquiries, such as checking balances and answering questions about recent transactions. These chatbots, by analyzing user data, can offer personalized responses, reducing wait times and creating a more positive experience for customers.

By being available 24/7, virtual assistants empower banks to assist customers outside traditional business hours, increasing accessibility and satisfaction. This round-the-clock support also enables human agents to focus on more complex issues, ultimately enhancing the overall quality of service.

4. Automated Credit Checks

Credit assessment has traditionally been a lengthy process, but AI is changing this. By utilizing automated algorithms, banks can now analyze extensive data—from credit histories to employment details—in a fraction of the time, producing precise and reliable credit scores.

With streamlined data analysis, automated credit checks save time and resources while minimizing errors. For instance, Zest AI, a US-based fintech company, reduced loan defaults by 20% using AI in credit risk evaluation, demonstrating AI’s capacity to revolutionize lending decisions.

5. Data Collection and Analysis

Banks process an enormous volume of data daily, and AI is critical in helping them manage and analyze this information effectively. By structuring and assessing data, AI provides insights that drive better decision-making and customer experiences.

This data-driven approach allows banks to offer services to individual customers by analyzing their behaviors and preferences. At the same time, AI enhances fraud prevention efforts by detecting anomalies such as unusual transaction patterns or suspicious activity that might go unnoticed by human analysts. Additionally, AI not only improves customer service but also strengthens security, making the data more valuable and strategic for the bank.

6. Investment Banking

In investment banking, AI is transforming decision-making and client interactions in areas such as corporate finance, mergers and acquisitions, and portfolio management. By analyzing market data, AI can guide investment strategies, assess risk, and offer tailored advice, all while maintaining regulatory compliance.

AI enables investment banks to operate with greater precision, optimize processes, and build stronger client relationships through more customized services and recommendations based on real-time data.

7. Process Automation

Robotic Process Automation (RPA) technology enhances operational efficiency and accuracy by automating repetitive tasks, freeing up employees to focus on more complex, value-added activities. This shift not only speeds up workflows but also reduces operational costs. Example: JPMorgan Chase’s CoiN technology leverages RPA to analyze and categorize documents at a speed that manual methods can’t match. This innovation showcases RPA’s potential to drive agility and streamline operations in the banking sector.

8. Predictive Analytics

Predictive analytics has become a game-changer in banking, allowing banks to spot emerging trends and make informed decisions. By analyzing patterns within the data, AI helps banks identify sales opportunities, cross-selling options, and other valuable insights for better business performance.

These insights help banks make proactive decisions, optimize customer engagement, and even enhance operational efficiency, all of which contribute directly to revenue growth.

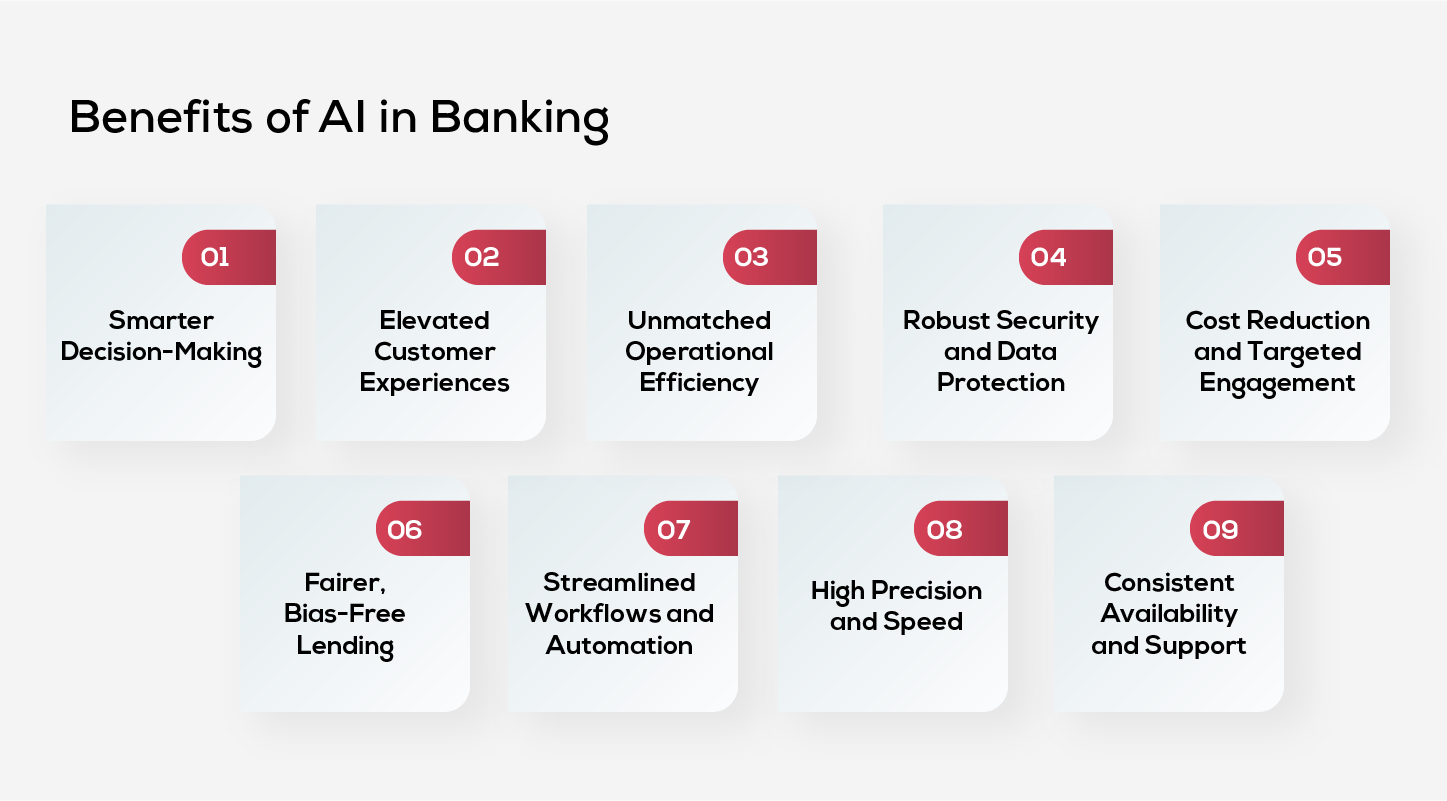

Benefits of Adopting AI in Banking

AI is transforming the way banks operate, making processes faster, smarter, and more efficient. From improving customer interactions to strengthening security, AI opens up new possibilities for growth and resilience in the financial sector. Here’s a look at how these benefits are shaping the future of banking:

1. Smarter Decision-Making

With AI’s powerful real-time data insights, banks make smarter, data-backed decisions that optimize credit assessments, investment strategies, and risk management. By leveraging AI’s predictive capabilities, financial institutions reduce default risks, uncover new revenue streams, and strengthen their competitive advantage. These AI-driven insights empower banks to adapt quickly to market changes, enabling prudent lending and investment choices that support sustainable growth.

2. Elevated Customer Experiences

AI-driven chatbots and virtual assistants redefine customer service by offering personalized, around-the-clock support. This allows customers to access help anytime, receiving quick, relevant answers to their inquiries without waiting. This seamless support improves customer satisfaction, cementing loyalty and building stronger relationships. By meeting customers where they are—at any hour—banks enhance the customer experience, creating a pathway for long-term retention and growth.

3. Unmatched Operational Efficiency

Through automation, AI handles time-consuming tasks like compliance monitoring, loan approvals, and fraud detection with remarkable speed and accuracy. This frees up skilled personnel to focus on high-impact activities, driving productivity and streamlining workflows. Banks benefit from reduced operational costs as AI takes on data-heavy tasks, allowing them to serve customers more efficiently and respond to business demands with agility.

4. Robust Security and Data Protection

AI plays a critical role in enhancing the cybersecurity measures of financial institutions by using sophisticated encryption techniques and real-time threat detection. As new cyber risks emerge, AI constantly refines its security protocols to protect sensitive data and prevent unauthorized access. This vigilant, adaptive approach ensures that banks maintain strong defenses against cybercriminals, building trust with customers and safeguarding their financial information from possible threats.

5. Cost Reduction and Targeted Engagement

AI enables banks to deliver tailored marketing and service recommendations that resonate with customers. By understanding customer preferences, banks can increase engagement and loyalty while reducing costs associated with customer acquisition. Additionally, AI-powered chatbots handle routine interactions efficiently, minimizing the need for large customer support teams. This smart, targeted approach lowers operational expenses, helping banks maximize their marketing spend.

6. Fairer, Bias-Free Lending

AI-powered credit scoring systems ensure that lending decisions are based purely on financial data, eliminating biases related to race, gender, or age. This approach promotes fairness and inclusivity in the lending process. As AI continuously learns and adapts, it reduces the risk of reinforcing past biases, fostering an equitable and transparent lending environment that upholds the principles of fairness and equal opportunity.

7. Streamlined Workflows and Automation

AI brings efficiency to banking operations by automating essential processes such as accounts payable, financial reconciliations, and customer service tasks. With workflows running autonomously, banks reduce operational bottlenecks and improve service delivery. This AI-powered automation is expected to save the banking industry billions by 2025, optimizing both resource allocation and employee productivity.

8. High Precision and Speed

AI boosts the precision and efficiency of financial services by automating data processing, analytics, and customer interactions. It minimizes human error while handling large datasets quickly, uncovering patterns that might be missed manually. With faster insights, banks can make informed decisions in areas like risk modeling, compliance, and customer service, helping them stay competitive in a fast-paced market.

9. Consistent Availability and Support

AI-driven financial services provide continuous, personalized customer assistance. Cloud-based AI systems operate continuously around the clock, managing customer needs and financial transactions without interruption. This reliability ensures that customers have access to support whenever they need it, enhancing their experience and deepening their connection to the bank.

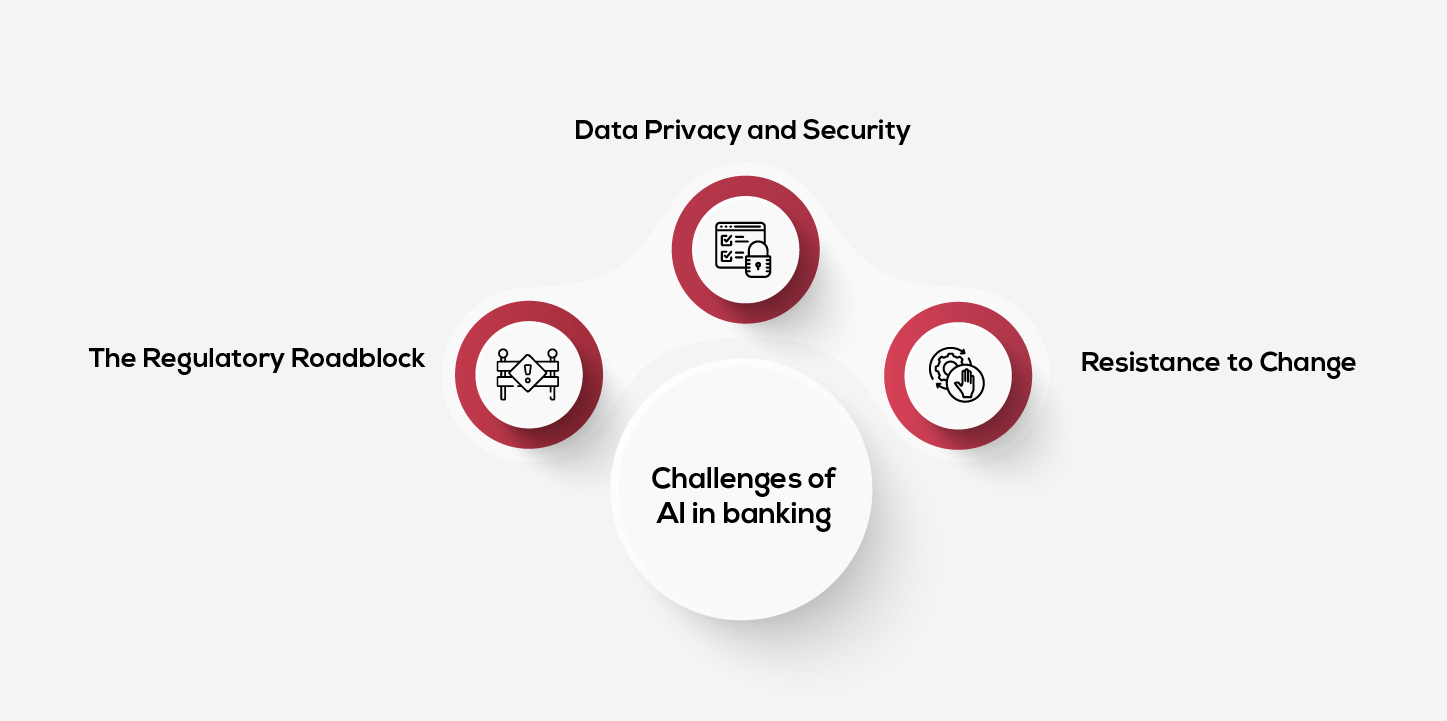

Challenges of Adopting AI In Banking

While AI offers transformative potential, its integration in banking isn’t without obstacles. Below, we examine the key hurdles financial institutions face as they navigate regulatory demands, ethical considerations, and the complexities of adopting advanced technologies.

1. The Regulatory Roadblock

Post-2008 financial crisis, banks operate under stricter regulations that control how much risk they can take, the cash they must keep on hand, and even the types of technology they’re allowed to use. For AI, this means that only certain types of models are permitted, especially when handling high-risk decisions like lending and capital reserves. These models must be transparent and easily explainable, limiting the use of advanced AI systems.

While complex AI models might offer better performance, they are often too difficult to explain in simple terms. Banks, therefore, rely on simpler models that regulators are comfortable with, even at the cost some accuracy. This emphasis on transparency and explainability means banks face challenges in adopting advanced AI, as they must balance innovation with compliance requirements.

2. Data Privacy and Security

In the banking industry, where vast amounts of sensitive data are collected daily, robust security measures are essential to prevent breaches, ensuring regulatory compliance, and maintain customer trust. . Selecting a technology partner with expertise in both AI and banking, along with a strong focus on security, is crucial to protecting customer information effectively.

Banks are cautious with new technologies like Large Language Models (LLMs) since they often involve sending sensitive data to third parties through external APIs. This reliance on external processing introduces security risks that can outweigh the prospective benefits, making strong data protection practices critical when adopting any AI-driven technology.

3. Resistance to Change

Large banks often resist change, not just because of regulations or security concerns, but due to their own risk-averse nature. They rely on longstanding, traditional methods for building models and scoring, making any shift to advanced AI challenging. Securing approval for new approaches often requires navigating multiple layers of governance, making it challenging for large banks to adopt changes quickly.

On the other hand, start-ups and fintech companies are more agile and open to adopting advanced AI, as they aren’t tied to legacy processes and are generally less risk-averse. However, they lack the capital and regulatory resources available to larger banks. As AI continues to evolve, smaller players may leverage its power to challenge traditional banks, gradually reshaping the industry.

Real-World Examples of Banks Integrating AI

With a clear picture of AI’s impact on banking, let’s explore real-world cases where financial institutions have leveraged AI to boost security, optimize processes, and offer more personalized customer experiences.

-

JPMorgan Chase

-

Bank of America

-

Citibank

-

ICICI Bank

-

HSBC

JPMorgan Chase utilizes AI to power a sophisticated fraud detection system that identifies and prevents fraudulent transactions in real-time. By analyzing vast datasets, including transaction, customer, and device information, the machine learning-based system enhances security and reduces fraud, protecting both the bank and its customers.

Bank of America leverages AI to personalize the banking experience for its customers. Using an AI-driven recommendation engine, the bank can suggest tailored products and services that align with each customer’s unique financial needs, offering a more relevant and engaging experience.

At Citibank, AI is transforming back-office operations by automating essential tasks. The bank’s AI system processes loan applications, reviews customer documents, and detects suspected fraud efficiently. This automation streamlines operations, improves processing speed, and enhances accuracy in handling customer transactions.

ICICI Bank has integrated AI across its services, from AI-powered chatbots like iPal that handle customer inquiries to advanced fraud detection systems that monitor transactions for suspicious activity. These AI-driven solutions improve customer support and strengthen transaction security, ensuring a smooth and safe banking experience.

HSBC has enhanced its mortgage lending process with AI to better assess borrower risk. By analyzing diverse data points, including non-traditional credit indicators, HSBC’s AI models offer a more comprehensive view of a borrower’s ability to repay. This nuanced approach to risk assessment allows the bank to offer mortgage loans to a broader range of qualified customers.

Future of AI in Banking

Exciting developments are on the way for artificial intelligence in finance. Here’s a look at some of the key trends and advancements to expect:

1. Hyper-Personalization

AI will allow banks to deliver highly personalized financial products, tailored to individual customer goals, including customized investment advice and loan options.

2. Enhanced Cybersecurity

AI-driven security systems will adapt in real time to evolving threats, continuously strengthening defenses against cyber risks.

3. Intelligent Automation

From customer onboarding to compliance checks, AI-powered automation will streamline key processes, reducing manual work and increasing efficiency.

4. Real-Time Decision-Making

AI will enable banks to make instant, data-driven decisions in areas like risk assessment, fraud detection, and credit approvals, accelerating service delivery and accuracy.

5. Voice and Facial Recognition

Advanced AI technologies like voice and facial recognition will provide secure, convenient authentication methods, transforming the customer experience with seamless access.

6. Voice-Activated Banking

The future of banking could be as simple as a conversation. With AI-driven voice assistants, customers may soon be able to handle a variety of banking tasks—such as checking balances, transferring funds, and setting up payments—just by speaking to their devices. This hands-free approach aims to make banking more accessible, convenient, and efficient.

7. Blockchain and AI Integration

The powerful combination of AI and blockchain technology promises to transform transaction security and efficiency. By optimizing blockchain networks, AI can enhance data processing speed and reliability, while improving the functionality of smart contracts. This integration paves the way for safer, more transparent transactions in the banking ecosystem.

Conclusion

In conclusion, while advanced AI holds great potential, a strong understanding of data science fundamentals remains essential in banking. As AI in finance continues to evolve, a holistic and responsible approach will be vital to ensure fairness, interpretability, and data protection amid growing scrutiny and regulation. By advancing collaboration between banks and AI experts, the industry can drive innovation, delivering enhanced services and operational efficiency that meet the needs of a rapidly changing digital world. The future of AI in banking is both promising and transformative, provided the right balance between technological advancement and responsible application.

Frequently Asked Questions

1. How is AI used in banking?

AI enhances banking by automating tasks like data entry, fraud detection, and loan processing, leading to lower costs and faster service. Chatbots provide 24/7 customer support, while AI also supports personalized banking experiences and proactive risk management.

2. How does Conversational AI work in banking, and what are its benefits?

Conversational AI uses natural language processing and machine learning to simulate human-like conversations. In banking, this technology powers chatbots and virtual assistants that provide around-the-clock support, answering customer inquiries and facilitating interactions across websites, mobile apps, and messaging platforms. By offering immediate assistance, conversational AI creates a more accessible and responsive experience for customers, making banking easier and more convenient.

3. Why does AI matter to financial services organizations?

AI is essential in financial services for risk management, market trend forecasting, and optimizing customer experiences. It equips customers with insights for better decision-making and helps banks stand out by offering advanced tools for managing finances. Given strict industry regulations, financial institutions must implement AI carefully to maintain compliance and manage risks effectively.

4. Which banks are using AI in India?

AI adoption in India’s banking sector is growing, with around 32% of financial service providers now using AI technology. Banks like SBI, Bank of Baroda, HDFC, ICICI, and Yes Bank leverage AI to streamline processes, improve customer service, and enhance overall operational efficiency.