Quick Summary: Rapid digitalization is reshaping the BFSI landscape, influencing how institutions operate and engage with customers. Beyond adopting technologies, success now depends on mindset, agility, and a commitment to meaningful change. Institutions must prioritize innovation while maintaining trust, efficiency, and long-term customer value. This blog highlights the critical shifts defining the future of BFSI.

The future of banking is rapidly being reshaped by rising customer expectations, stringent regulatory demands, and the unstoppable march of digital innovation. In a world where instant, personalized service is the norm, and transparency is mandatory, banks must evolve—or risk falling behind.

The BFSI (Banking, Financial Services, and Insurance) sector, once known for its cautious approach, is now at the forefront of transformation in 2025. The shift is driven by tech-savvy consumers who demand personalized interactions by escalating cybersecurity risks that require stronger alliances with fintech innovators. Together, these factors are creating a dynamic, technology-first banking environment.

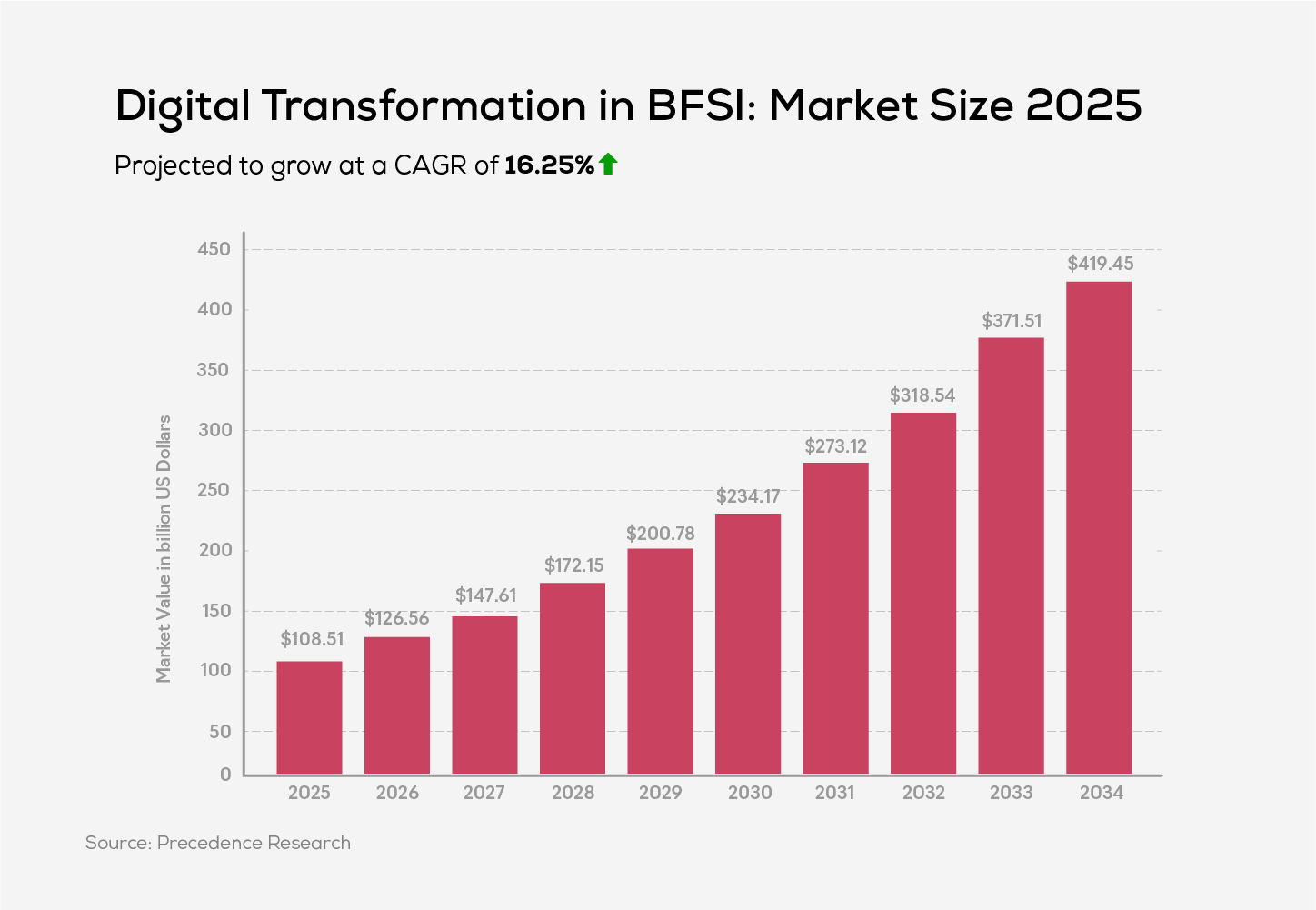

The digital transformation market within BFSI sector is witnessing rapid expansion. According to Precedence Research, the market was valued at $93.04 billion in 2024 and is expected to reach $108.51 billion in 2025. By 2034, it is projected to surpass $419.45 billion, expanding at a compound annual growth rate (CAGR) of 16.25% from 2025 to 2034. This exponential growth underscores the need for financial institutions to accelerate innovation, strengthen customer engagement, and future-proof their operations.

Key Digital Trends Shaping BFSI

The BFSI sector is moving into a new digital era where agility, security, and customer-centricity are becoming key priorities. In response, organizations are adopting smarter technologies and rethinking how value is delivered across every touchpoint. The following trends highlight how digital priorities are taking shape across banking, financial services, and insurance.

1. AI-Powered Personalization

Banks are increasingly utilizing artificial intelligence to analyze customer data—such as spending patterns, transaction histories, and financial goals—to understand individual preferences. This enables the delivery of personalized services, including tailored product recommendations, spending insights, and custom alerts. Additionally, AI-powered virtual assistants and chatbots provide real-time, context-aware support, enhancing customer engagement and satisfaction.

2. AI-Driven Cybersecurity

As digital transformation accelerates in the BFSI sector, cybersecurity has become a paramount concern. With an increasing dependence on cloud platforms, open banking, and fintech collaborations, the financial institutions are adopting zero-trust models, utilizing AI-driven threat detection, and implementing blockchain technology for fraud prevention. These proactive strategies not only protect data and strengthen security but also strengthen customer trust, paving the way for secure innovation within the BFSI landscape.

3. The Rise of Hyper-Automation

Banks are adopting hyper-automation to modernize their processes due to the demand for faster and smarter operations. By integrating robotic process automation (RPA), AI, and machine learning, financial institutions are simplifying complex workflows—from compliance verification to loan processing. This shift minimizes manual errors, lowers operational costs and allows teams to focus on strategic priorities that strengthen customer relationships and support long-term growth.

4. Cloud-Driven Innovation

The need for greater flexibility, resilience, and faster innovation is driving banks and financial institutions to rethink their core infrastructures. Cloud technology is cementing its role as a strategic foundation for the BFSI sector, helping banks modernize operations, roll out digital services faster, and optimize costs. It is also enabling the rise of digital-only branches, improving real-time risk management, and strengthening disaster recovery, making cloud adoption a key pillar for future-ready banking.

5. Composable Banking Applications

Traditional monolithic systems no longer offer the flexibility needed to meet evolving customer expectations. In response, financial institutions are shifting towards composable application architectures. This modular approach allows for pre-built components and services to be reused across systems, reducing development time and technical debt. Composable applications promote agility, enhance scalability, and speed up time-to-market. Banks adopting this approach can respond more quickly to market changes and integrate emerging technologies with ease.

6. RegTech for Compliance

Financial institutions are under constant pressure to keep up with shifting regulations, especially as digital operations expand. Manual compliance processes often lead to delays, inconsistencies, and increased operational costs. RegTech—short for regulatory technology—offers a smarter solution by automating core compliance activities. Through AI, machine learning, and real-time data analytics, these tools streamline reporting, monitor transactions, and detect anomalies before they escalate. This results in faster audit readiness, reduced regulatory risk, and improved accuracy across compliance workflows.

7. Biometric Authentication Methods

Traditional login methods like passwords and PINs are proving insufficient against sophisticated fraud attempts. Biometric authentication offers a secure and user-friendly alternative by using unique biological traits such as fingerprints, facial recognition, or voice patterns. These technologies are increasingly being used for customer onboarding, transaction verification, and secure app access. The result is faster login experiences, reduced fraud risk, and greater customer confidence.

8. Open Banking Frameworks

Banking is moving beyond traditional silos, with customers now expecting more control over their financial data. Open banking enables this shift by allowing users to share their data securely with third-party providers through APIs. This collaborative model fosters innovation and allows banks to partner with fintechs to deliver value-added services. Customers benefit from personalized offerings, unified financial views, and seamless app integrations. For banks, it opens up opportunities to stay competitive and drive new revenue models.

9. The Shift to Embedded Finance

Financial services are becoming less visible yet more deeply embedded into consumers’ everyday digital experiences. Embedded finance allows non-financial platforms—like online marketplaces, mobile apps, and ride-sharing services—to offer integrated banking products such as payments, lending, and insurance. By simplifying access within familiar platforms, businesses can enhance customer loyalty and create new value streams without the traditional boundaries of banking.

10. Next-Gen Payment Processing

The rise of mobile wallets, contactless cards, and instant payment platforms has transformed how consumers manage transactions. Financial institutions are now adopting real-time payment systems that ensure speed, transparency, and reliability. These innovations offer seamless payment experiences across devices and channels, supporting both retail and corporate users. Enhanced security features, such as tokenization and biometric authorization, further strengthen trust. With payments becoming more integrated into everyday apps and platforms, banks must continue innovating to keep pace with customer demand.

BFSI Success Stories in Digitalization

Here are some success stories that demonstrate how organizations have embraced the advanced technologies to improve operations, enhance service delivery, and build long-term resilience in a fast-changing landscape.

1. DBS Bank’s Digital Transformation Journey

DBS Bank in Singapore is a front-runner in BFSI digital transformation. With the launch of the DBS Digibank platform, the bank offers a fully digital banking experience, allowing customers to access a range of financial services via mobile. Leveraging AI and machine learning, DBS provides personalized financial insights and seamless customer experiences—setting a benchmark for innovation in the banking industry.

2. Bank of America: AI-Powered Virtual Assistant 'Erica'

Bank of America has been at the forefront of integrating artificial intelligence into its customer service operations. Their AI-driven virtual financial assistant, Erica, has facilitated over 2.5 billion interactions since its launch in 2018, assisting more than 20 million clients with tasks such as money transfers, bill payments, and tailored financial recommendations that make banking more intuitive and efficient.

3. HSBC: Leveraging AI and Cloud Technologies for Enhanced Services

HSBC has embarked on a comprehensive digital transformation journey, focusing on leveraging AI, machine learning, and cloud technologies to improve customer experiences and operational efficiency. The bank has partnered with Google Cloud to automate the quality review of its contact center sales calls, significantly reducing the time required for such reviews and enhancing customer service.

Advantages of Digitalization in the Banking Sector

Digitalization in banking has unlocked new possibilities that were once unimaginable—bringing faster access to services, mobile-first experiences, and entirely new models of engagement. As technological advancements continue to redefine what’s possible, understanding the key advantages of digitalization is crucial for institutions aiming to thrive in a technology-driven financial world.

1. Stronger Customer Loyalty

Personalized digital experiences make customers feel valued and understood, leading to higher satisfaction and stronger long-term loyalty to the bank.

2. Higher Customer Acquisition Rates

Digital tools enable precise targeting and tailored communication, helping banks attract new customers more efficiently and at a lower cost.

3. Greater Product and Service Adoption

Customized recommendations increase the likelihood of customers adopting new financial products, boosting cross-selling and upselling success rates.

4. Increased Revenue Opportunities

Personalized engagement strengthens customer relationships and opens new revenue streams through better product fit and higher lifetime customer value.

5. Improved Cost Efficiency

Automation and smarter targeting reduce operational and marketing costs, allowing banks to achieve higher profitability with optimized resources.

6. Expanded Reach and Financial Inclusion

Digitalization enables banks to reach underserved communities through mobile platforms and fintech collaborations, driving customer growth and promoting inclusive access to financial services.

Strategic Priorities for Driving Digital Innovation in BFSI

The future of the BFSI sector will be shaped by institutions that align technology initiatives with evolving customer expectations, regulatory landscapes, and operational demands. Prioritizing the right strategies today will define success in tomorrow’s digital economy. Here are the key areas technology leaders must focus on:

1. Develop a Future-Ready Technology Roadmap

Building a strategic technology roadmap that aligns digital initiatives with business goals is critical. A phased, scalable approach enables institutions to implement innovations effectively while maintaining flexibility to adapt to evolving market needs.

2. Modernize IT Infrastructure with Cloud Adoption

Upgrading legacy systems and embracing cloud computing models—such as Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS)—enhances scalability, resilience, and cost-efficiency, enabling seamless delivery of digital services across customer touchpoints.

3. Embrace Agile Frameworks for Faster Innovation

Adopting agile methodologies, such as DevOps and iterative development, empowers institutions to accelerate product delivery, improve cross-functional collaboration, and respond quickly to changing customer and regulatory demands.

4. Build Strategic Partnerships and Ecosystem Collaborations

Partnering with fintechs, insurtechs, regtechs, and technology providers opens new avenues for innovation. Ecosystem-driven collaboration enables faster access to emerging capabilities, expansion into new markets, and the creation of integrated financial services.

5. Maintain a Strong Focus on Regulatory Compliance and Risk Management

Navigating an increasingly complex regulatory environment requires continuous investment in RegTech solutions, automated reporting systems, and proactive risk management frameworks—ensuring operational integrity and protecting customer trust.

Future Outlook: Evolving with Purpose

The future of the BFSI sector hinges on how effectively institutions apply today’s digital priorities with long-term intent. AI, cloud, and hyper-automation are already part of core operations, while emerging capabilities like RegTech, biometric authentication, and composable applications bring new layers of possibility. These tools are enablers—but lasting progress depends on how meaningfully they’re used.

As customer expectations shift and industry boundaries blur, financial service providers must stay focused on trust, clarity, and responsible growth. Collaborating across ecosystems, adopting flexible models, and building seamless yet secure digital experiences will be key to staying relevant.

Looking ahead, success in BFSI will depend on more than technology choices. It will require a clear direction, continuous learning, and a commitment to delivering value with purpose.

Frequently Asked Questions

1. Why is digital transformation crucial for the BFSI sector?

Digital transformation enables financial institutions to meet evolving customer expectations, stay competitive, and operate efficiently in today’s digital world. It helps banks and financial service providers offer personalized experiences—ultimately driving growth and long-term relevance in the market.

2. How does AI help in banking?

AI helps banks understand customer habits, offer personalized services and improve things like fraud detection and customer support.

3. What challenges do BFSI institutions face during digital adoption?

Common challenges include legacy system limitations, regulatory complexities, skill gaps, and internal resistance to change.

4. Is automation reducing human roles in BFSI?

Automation is shifting roles, not eliminating them—enabling professionals to focus on strategy, analysis, and customer relationships.

5. What skills are essential for a future-ready BFSI workforce?

Data literacy, cybersecurity awareness, agility in learning, and collaboration across tech and business teams are key competencies.