Quick Summary: In the rapidly evolving landscape of financial technology, the role of core banking software has become more essential than ever. Core banking stands as the ultimate solution for prioritizing customer satisfaction and delivering personalized and responsive banking experiences. In this article, we dive into the world of core banking solutions and their advantages. Additionally, we present a selected list of popular core banking software companies.

Advancements and innovations are increasing rapidly in the industrial world, and banking and finance are no longer exceptions today!

One such advancement is digitalization, which is changing the world, particularly in the banking sector where numerous companies are competing for customers. Thus, to thrive in the financial landscape, banks must remain consistent, safe, modern and flexible. In the past, traditional banks held a prominent position in the financial sector. However, several factors have since altered the landscape, diminishing their prominence.

Traditional banks now face competition from fintech startups, companies that heavily rely on technology to offer innovative financial services. Can you believe how much the fintech industry has grown over the past few years? It might sound exciting! The growth of fintech companies in 2023 was 26,393 and has surged to over 29,955 in 2025 in America.

According to Grand View Research, the global core banking software market was valued at USD 12.4 billion in 2024 and is projected to grow at a CAGR of 10.2% from 2025 to 2030.

But, before we dive into the topic directly, here are some of the common questions you need to ask yourself.

- What is core banking?

- What does the core banking system do?

- What is the future of core banking?

Understanding Core Banking

The term CORE Banking stands for “Centralized Online Real-Time Exchange”, serving as a connecting branch that allows customers to access accounts and execute basic transactions at any branch location. It includes deposits, withdrawals, loan and credit processing, account management and customer support.

Customers can view their account information from any branch within the network. Core banking systems are fundamental for ensuring the reliability, security and efficiency of financial services delivery and combine with ATMs, online and mobile. They streamline transaction and customer data management for banks and allow customers with real-time account access to a wide range of services.

Curious about the journey of core banking from traditional systems to digital solutions? Dive deeper into the need for core anking system modernization and advantages in The Core Banking Lifecycle From Legacy Systems to Digitalization.

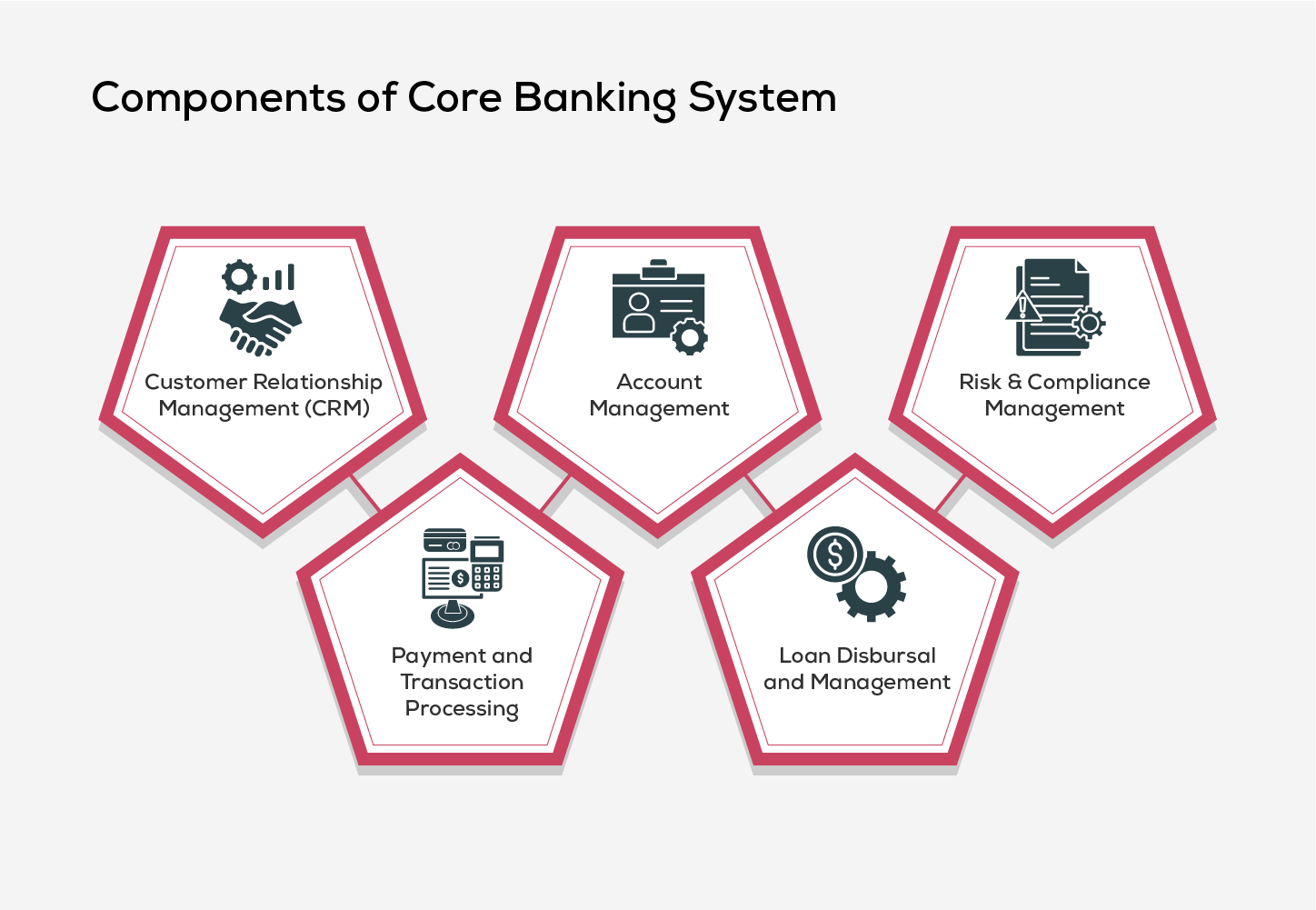

Components of Core Banking System

A core banking system is an essential framework for financial institutions to efficiently manage their operations and offer a wide range of banking services. Here is the list of components of the core banking system.

1. Customer Relationship Management (CRM)

One of the primary goals of banks is to provide the best service for their customers. But how do you do so? The answer lies in customer relationship management. As the name suggests, CRM identifies the potential customers, preferences and existing relationships, enabling personalized customer service.

Advantages:

- Increased customer retention

- Drives revenue growth

- Improved customer satisfaction

2. Account Management

Account management is a crucial component of the core banking system. It facilitates customer onboarding, maintenance processes from account creation to closure, manage customer accounts and transaction history. It provides a unified view of customer information, allowing one to track balances and manage accounts and statements.

Advantages:

- Enhanced security

- Cost saving

- Increased growth potential

3. Risk & Compliance Management

These tools help banks identify, assess and manage various risks, including market, credit, and operational risks. Analyzing data and user activity helps the system identify issues like credit risks or vulnerabilities. This allows for early intervention and steps at an early hand.

Advantages:

- Enhanced financial performance

- Effective planning

- Better decision-making

4. Payment and Transaction Processing

Payment and transaction processing is the cornerstone of financial institutions. It involves mechanisms that ensure the accurate flow of money, including deposits, withdraws, bill payments and fund transfers. This ensures that the transactions are streamlined precisely and efficiently.

Advantages:

- Reduced labour costs

- Boosts the brand value

- Enhanced security and compliance

5. Loan Disbursal & Management

The loan management system uses cutting-edge AI to handle every step of the loan process. This advanced technology replaces time-consuming traditional methods for verifying applicants' credibility and financial information.

Advantages:

- Provides useful analysis and insights

- Useful for managing customer information

- Keeps record of all the financial statements

Types of Core Banking Solutions

Core banking solutions come in various types, each designed to meet the different needs and preferences of financial institutions. Let’s take a look at the types to better understand core banking solutions.

1. On-Premise

A bank that uses software hosts all its IT infrastructure, hardware, and software applications on-site rather than in the cloud. These systems run on the bank's local servers, meaning all information is stored locally. On-premise solutions are designed to manage processes such as transactions, loans, deposits, and customer accounts. This approach offers greater control and enhanced data security.

2. Web-Based

Gone are the days when you stand in line to open an account. Web banking has made our lives easier than ever! Technological advancements have revolutionized every industry, with the banking sector now embracing cutting-edge changes.

Web banking, also called Internet banking, is a service that allows you to access your bank account anytime, anywhere, around the clock. The features of web banking allow users to manage finances anytime. With 24*7 access, users can transfer funds, pay bills and recharge, check account balances, open deposit accounts and apply for loans.

3. Cloud-Based

Cloud banking refers to the on-demand delivery of a variety of hosted computing services over the internet. These services include servers, data storage, networking tools, and are utilized by credit unions, data analytics firms, fintech companies and other financial institutions. Cloud-based banking utilizes remote servers to process data, deliver customer services, and run applications. It enhances the overall banking experience by offering greater scalability, flexibility and accessibility.

4. Open-Source

Open-source banking, also known as open bank data, enables banks to securely share their financial information with third-party services through Application Programming Interfaces (APIs). It creates a network where the financial data can securely flow between banks and institutions. The advantages of open banking include enhanced security, simplified account management, instant digital payments and streamlined financial processes.

What to Look for in Core Banking?

To stay ahead in the evolving market trend, it is important to evaluate the characteristics of the core banking solutions. The comprehensive checklist of criteria must encompass the following:

- Technology stack

- User experience

- Security protocols and credentials

- Support and maintenance

- Built-in compliance tools

- Integration capabilities

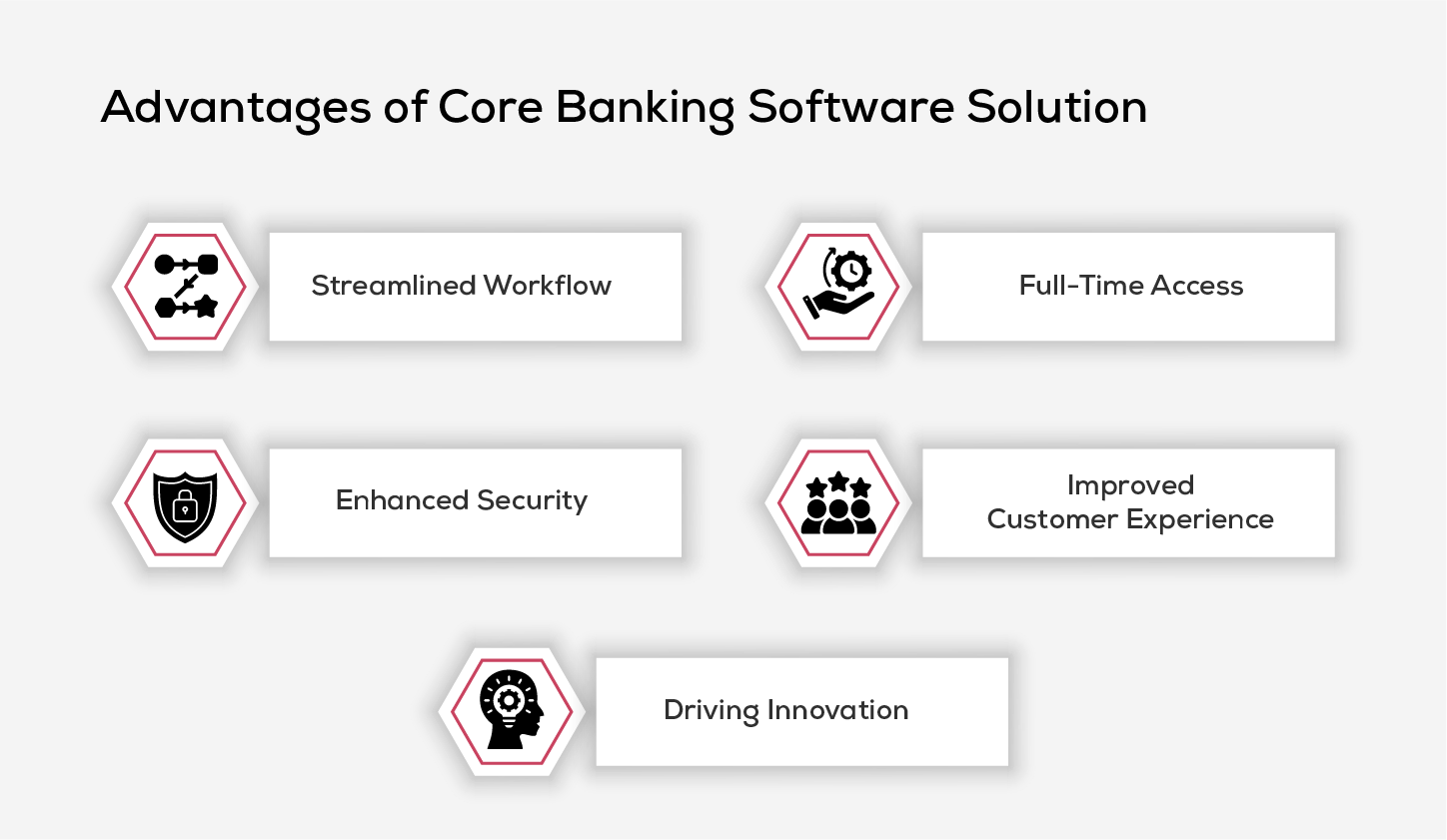

Advantages of Core Banking Software Solution

In the fast-paced digital landscape, traditional banks are being transformed by advanced technology. Everything has got you at your fingertips, from sending payments to managing bills! Listed below are the advantages of a core banking solution.

1. Streamlined Workflow

Core banking software automates manual processes, eliminating delays and enabling quicker transaction processing for tasks such as depositing a check, transferring funds, or making payments.

2. Full-Time Access

The core banking system enables users to check balances, pay bills, or transfer funds around the clock. Customer support is available 24/7 to assist with any issues encountered during banking operations.

3. Enhanced Security

A core banking system can maintain security and safety with an advanced level of encryption model. The added level of Two-Factor Authentication (2FA) and bio-verification makes the core banking solutions secure.

4. Improved Customer Experience

Customers can access their accounts, manage finances and make transactions through real-time processing. This creates a sense of trust and convenience for customers, leading to higher satisfaction and loyalty.

5. Driving Innovation

By integrating technologies like artificial intelligence, data analytics and blockchain, banks can enhance their services with data-driven solutions. Embracing core banking solutions enables banks not only to keep pace with technological advancements but also to lead the charge. This allows them to offer innovative and efficient services, gaining a competitive edge in today's digital-first world.

List of Core Banking Software Companies

Core Banking software companies are the backbone of the financial industry, providing the technology that enables banks to operate smoothly and deliver a seamless customer experience in the digital age. Below is a list of core banking software companies.

-

Finacle

Finacle, a cloud-based core banking solution from Infosys, is helping financial institutions take the future of banking to the next level. It serves over 1 billion customers worldwide with the presence of 100+ countries that deliver banking needs across the globe. Finacle provides greater customer insights that provide information to personalized offerings and develop targeted products.

-

Temenos

Established in 1993, Temenos is a leading provider of core banking software, boasting over 25 years of experience serving financial institutions. Temenos understands customer needs and delivers modern banking solutions. Trusted by over 3,000 clients, including 41 of the world’s top 50 banks, their platform supports private banks, corporate, enterprise credit, and retail sectors.

Did you know? Temenos recently launched Generative AI solutions for banking, enhancing data handling, boosting productivity, and driving profitability. With Temenos Generative AI, banks can quickly generate insights and reports simply by asking questions in plain language.

-

Mambu

As core banking systems are playing a predominant role in the industry, Mambu’s growth is shifting the banking software market to another level. Since its launch in 2011, Mambu’s core banking platform has reached a significant reach serving over 100 microfinance organizations within two years. Today, they serve over 150 banks and fintech companies, reaching over 14 million end-users worldwide and helping top companies including N26, Orange and Santander.

-

Backbase

Backbase is a trusted partner for over 80+ banks globally which enables financial institutions to prioritize digital transformation, making it dominant in their business strategies. Backbase's Omni-Channel Banking Platform is the trusted choice for banking technology for companies like Barclays, Credit Suisse, Deutsche Bank, Fidelity and ING. It brings in 90 million customers every day as it focuses on the unparalleled speed of implementation and customer experience management.

-

Securepaymentz

Securepaymentz prioritizes security, enabling financial institutions to offer a secure and convenient banking experience, particularly for mobile and online payments. Additionally, it features a dedicated subscription space that provides regular updates for its customers.

-

nCino

nCino was founded in 2012 in Wilmington, North Carolina, USA, as a response to the inconveniences of the commercial loan process. In less than a decade, they've transformed into a leading provider of the nCino Bank Operating System (nCino BOS). This platform improves the customer experience and reduces costs.

-

Bricknode

Bricknode, a Swedish fintech company, is a leading digital transformation in the financial services industry. Its cloud platform empowers financial institutions to construct custom banking solutions that perfectly match their unique needs. With ready-to-use modules, customers can fund, trade, deposit and lend or connect their apps through the API platform.

-

Finastra

Finastra empowers financial institutions worldwide with integrated solutions. This approach streamlines operations, boosts efficiency and focuses on customers. It carries a wide range of banking operations starting from transaction banking to capital markets and retail.

-

Oracle FLEXCUBE

Oracle FLEXCUBE is a global force in financial inclusion and accounts for 10% of the world population covering almost 140+ countries. This adaptable and flexible banking software meets essential banking requirements and encourages innovation. Oracle FLEXCUBE platform is the perfect choice for financial services aiming to launch retail banking software and solutions.

The Future of Core Banking

The future of banking is set for transformation driven by emerging technological trends. These technological trends are reshaping the banking landscape, driving innovation, enhancing customer experiences and transforming how financial services are delivered. Let's dive into the emerging key trends shaping the banking industry.

-

Instant Real-Time Banking

Traditional banking often involves delays between when a transaction occurs and when it is reflected in your account balance or when you receive a notification. These delays can be frustrating for customers.

Real-time banking eliminates these delays. Transactions are processed instantly, account balances are updated immediately, and customers receive notifications in real-time.

-

Open Banking

Open Banking is transforming the financial industry by boosting financial transparency and data sharing between banks and third-party providers. This creates a space for an innovative banking ecosystem by providing customers with personalized financial services.

-

Artificial Intelligence and Machine Learning

AI and ML are driving the financial industry to another level by driving more predictive banking solutions. These advanced technologies improve the efficiency and security of operations from personalized customer services to fraud detection.

-

Blockchain

Blockchain technology is the next big thing happening in the financial world. It is known for improving security, efficiency and transparency. They provide secure transactions by presenting a significant advancement in banking technology.

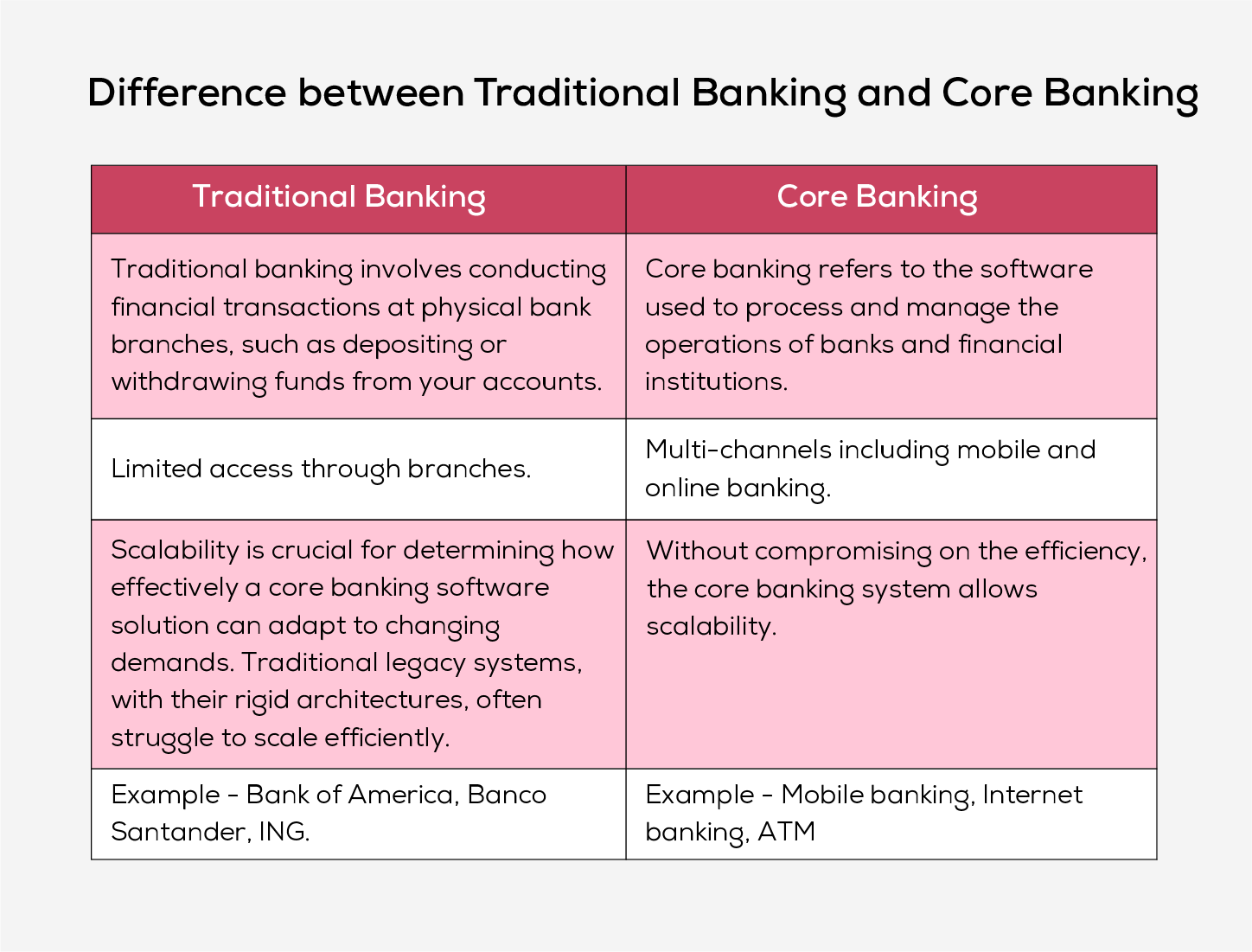

What is the Difference between Traditional Banking and Core Banking?

Are You Ready to Stay Ahead of Financial Trends?

How can you stay ahead of the curve with emerging technologies like core banking solutions? The numerous advantages of core banking solutions allow both customers and institutions to stay ahead by enhancing efficiency, increasing customer satisfaction and reducing costs.

By partnering with Inspirisys, you can start a journey towards modernizing your banking operations. With our vast experience and expertise in CBS architecture, Finacle Tools & Services and interfacing capabilities, we ensure seamless integration and enhanced operational efficiency for your bank. To address the demands of the banking sector, Inspirisys stands to deliver adaptable solutions.

Frequently Asked Questions

1. What are the key technology components of Core Banking Solutions?

Web environment, security solutions, application environment, database environment, enterprise security architecture and online transaction monitoring for fraud risk management.

2. What is a proxy server?

A proxy server is a computer network service that provides a network service for clients to make direct connections to other network services. A client connects to the server and then requests access to a connection or file located on a different server. The requested file is then provided either by connecting to the server or serving it from a cache.

3. What is Internal Control in Banks?

Risks are managed by employing internal controls suitable to the business environment. These controls must be incorporated into the IT solutions at the bank’s branches. Some examples of internal controls in banks include job rotation among staff, details of lost security forms being reported immediately so that they can take precautions and the financial and administrative powers of each official/position being clearly defined and communicated to everyone involved.

4. What is the impact of technology on banking?

The four key components of the banking business include business processes, policies and procedures, regulatory requirements and organizational structure, with controls combined throughout these areas. The technology platform is formed according to the bank's specific business style to offer new products and services.

5. What are the key components of CBS?

Central Server, ATM Switch, Branch Banking, Credit Card System, Data Warehouse and Internet Banking.