Quick Summary: Navigating the core banking software landscape can be complex with numerous options available. Choosing the right system is crucial for financial institutions aiming to remain competitive. This blog provides a critical comparison of two leading core banking solutions: Temenos and Finacle. We’ll explore their key differences and strengths, helping you determine which platform best suits your organization’s needs for enhancing operational efficiency and customer experience.

In an era where banking needs to keep pace with technological advancements and heightened customer expectations, traditional methods just don’t cut it anymore. Imagine transforming your bank into a sleek, digital powerhouse where managing transactions, accounts, and customer interactions is as simple as a tap on a smartphone.

Core banking systems (CBS) are at the heart of this transformation, turning complex processes into seamless, efficient experiences. As the financial landscape evolves, embracing cutting-edge CBS solutions is crucial for banks aiming to lead in the digital age.

Dive into this blog to discover how these systems can revolutionize your operations and elevate customer satisfaction, positioning your institution at the forefront of innovation.

What is a Core Banking Solution?

Gone are the days of slow service and long lines at the bank. Core banking solutions have fundamentally transformed the banking experience, bringing efficiency and speed to every transaction.

Core banking, which stands for Centralized Online Real-time Exchange/Environment, is a technology that powers modern banking by enabling real-time online transactions and centralized account management. This advanced system not only enhances operational efficiency but also ensures the security of customer information and funds. By providing real-time access to accounts and a comprehensive suite of banking services, core banking solutions are essential to meet the evolving demands of today's digital-first customers.

Key features of core banking include:

- Transaction processing

- Loan processing

- Payment processing

- Deposit processing

- Interest calculation

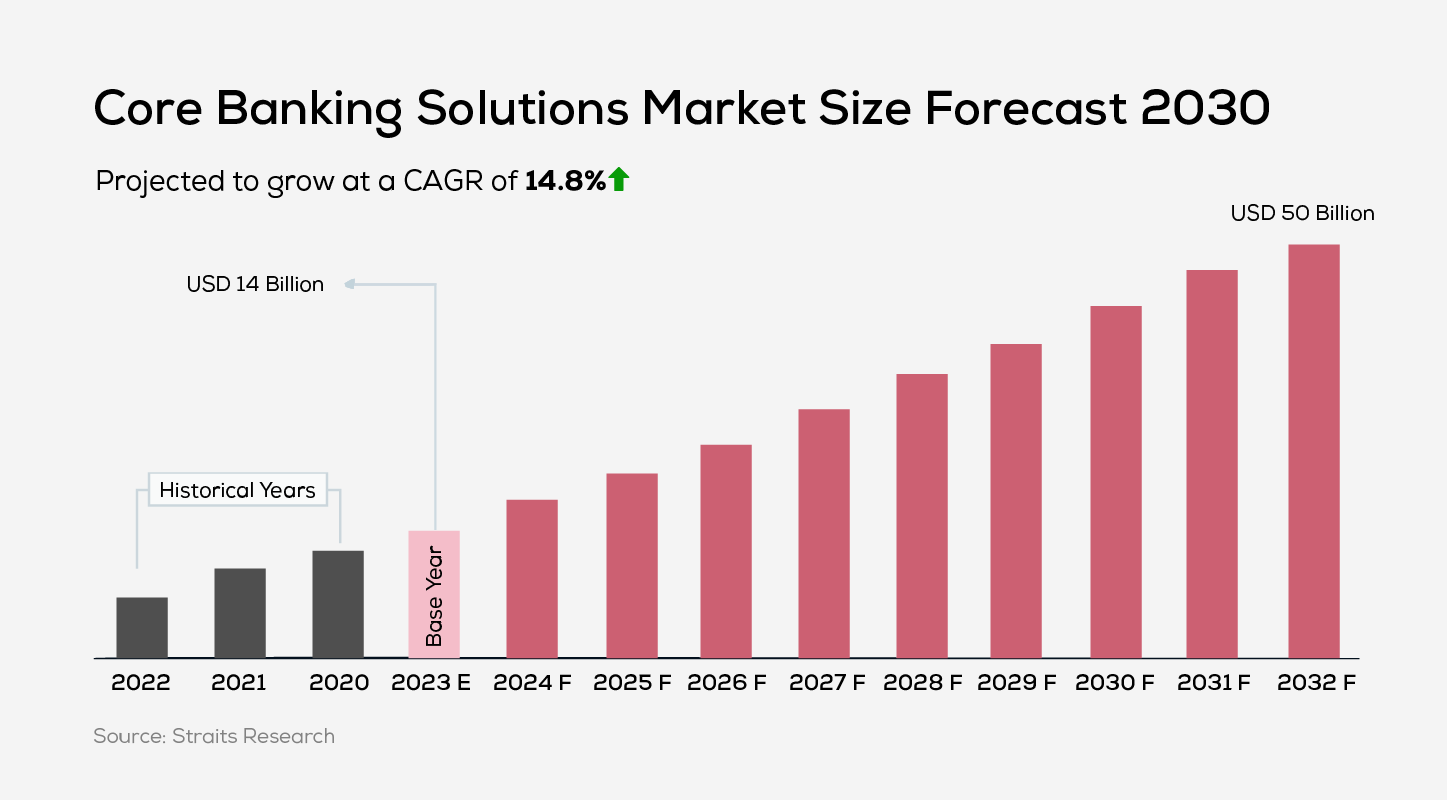

The rising demand for advanced banking technologies underscores the significance of core banking solutions. In fact, the global core banking market was valued at USD 14 billion in 2021 and is expected to surge to USD 50 billion by 2030, with a compound annual growth rate (CAGR) of 14.8% during the forecast period (2022–2030).

The banking industry is rapidly adopting advanced technologies like cloud computing, RPA, chatbots, artificial intelligence, machine learning, and blockchain. These innovations, when integrated with core banking solutions, enable banks to conduct effective customer analysis and streamline transactions. As a result, many banks are adopting these solutions to enhance service delivery, which, in turn, is driving significant growth in the market.

Architectural Framework of Core Banking Solutions

The core banking system is built on an architectural foundation that ensures efficient operations and seamless communication across various banking solutions.

Acting as the central hub of a bank, it manages crucial functions such as account creation, transaction processing, loan management, and customer relationship development. At its core lies a database that stores and attains large quantities of customer data, transaction records and other vital banking information.

Customers access the core system through channels like ATMs, internet banking, branches and mobile apps. An integration layer links the core system to other platforms such as risk management and regulatory reporting, ensuring smooth data flow across banking operations.

Security features, including user authentication, access controls and encryption protocols, safeguard the privacy of sensitive data. Additionally, the analytics tools unlock valuable insights into customer behaviour, transaction patterns, and operational performance, aiding in informed decision-making.

Middleware and message queuing systems act as the controllers, ensuring smooth communication between different components of the core system and enabling real-time processing. Moreover, business process management tools automate and streamline critical tasks like loan applications, account openings and customer onboarding, ultimately boosting overall productivity.

The core banking system ensures scalability, adaptability to changing business needs and flexibility in the evolving technological landscape. This capability empowers banks to manage operations securely and deliver better banking experiences.

Features of Core Banking Solutions

Core banking solutions are crucial for modern financial institutions, integrating advanced technologies to meet the demands of the banking sector. Here is the list of key features offered by core banking solutions:

1. Real-Time Transaction Processing

Real-time transaction processing is a critical feature of core banking systems ensuring that financial activities such as deposits or transfers are updated immediately within the system. This payment system is crucial for enhancing customer satisfaction and maintaining accurate banking records, and ensuring efficient and reliable service.

2. Multi-Channel Support

Customers accessing core banking services benefit from multi-channel support, which allows them to interact with their bank through various mediums such as mobile apps, websites or in-person visits, ensuring a smooth banking experience.

3. Know Your Customer (KYC) Onboarding

Core banking systems play a vital role in Know Your Customer (KYC) onboarding, where banks verify the identities of new clients. While traditional methods relied on physical documents, modern core banking systems now facilitate online ID submission.

These advancements streamline the KYC process, boost efficiency and ensure regulatory compliance, resulting in a smoother experience for both banks and customers.

4. Multi-Factor Authentication (MFA)

As the name suggests, multi-factor authentication (MFA) is a security measure that requires customers to verify their identity with an additional step, like a one-time passcode to secure sessions and transactions. The core banking systems centralize data and facilitate mobile access, enhancing overall security.

Temenos vs. Infosys Finacle: In-Depth Comparison

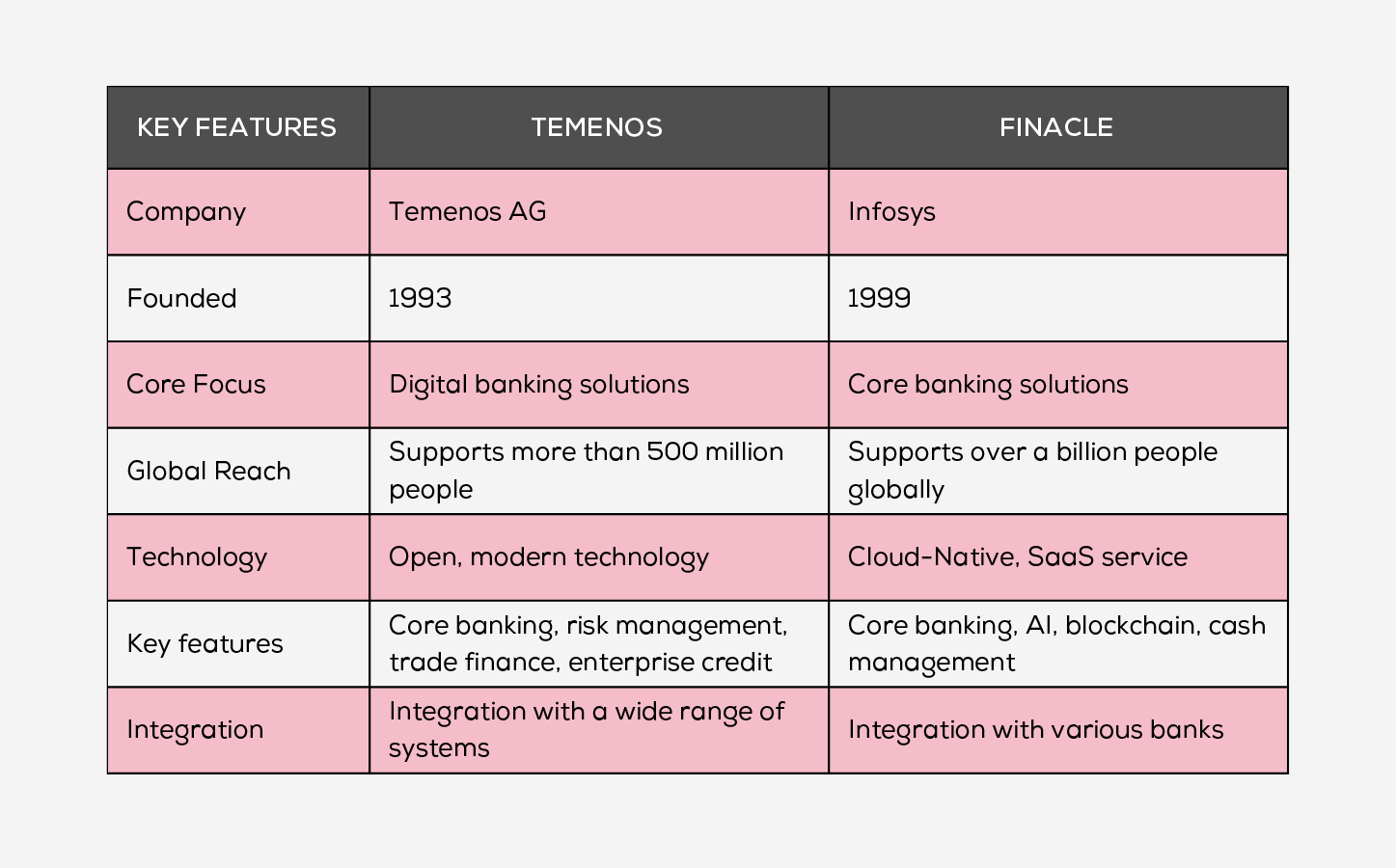

The rise of next-generation banks is making waves in the financial sector, prompting traditional institutions to rethink their outdated platforms. As these new players gain market share by focusing on specific segments of the value chain, the need for advanced core banking systems becomes increasingly evident. Choosing the right CBS is essential to staying competitive in this evolving landscape. Join us as we explore the unique strengths of two leading core banking solutions, Temenos and Finacle, to determine which can best propel your bank into the future.

Understanding Temenos:

Temenos, established in 1993, is a leading global core banking software system. With over 25 years of experience, Temenos has established itself as a prominent provider, offering improved efficiency, enhanced customer experience and a competitive edge. This platform allows banks to manage transactions and mitigate risks effectively and supports a wide range of financial institutions, from private banks to corporate banks.

Advantages of Temenos:

- Adaptability

Temenos helps banks adapt to changing market demands and remain flexible for the future.

- Enhancing Customer Service

Temenos empowers banks to innovate faster with modern technology. Banks can develop new products and services, while staff benefit from a streamlined system, ultimately enhancing user engagement and reducing overall costs.

- Driving Global Innovation

Providing service to over 3,000 clients, Temenos supports more than 500 million daily users. Built on top-tier features and cutting-edge technology, the platform unlocks a world of possibilities and innovation.

Discovering Finacle

Finacle by Infosys, is a leading digital banking solution that empowers banks to meet the evolving needs of their customers. This platform serves over 1 billion customers and is used in over 100 countries. Finacle accelerates digital transformation with its real-time processing engine and customer insights, enabling banks to deliver a seamless digital experience.

Advantages of Finacle:

- Advanced Security

Finacle prioritizes security by protecting cloud infrastructure, employing advanced data security measures and implementing cybersecurity protocols. Specialized SaaS modules further ensure enhanced data privacy and control.

- Driving Innovation

Finacle's commitment to product support makes it a valuable partner for banks looking to capitalize on open banking opportunities. Fueled by strong demands, Finacle's open banking solutions empower clients to develop innovative business models centred on secure API-driven distribution of banking products and payments.

- Addressing Challenges with Finacle Solutions

For banks, staying ahead in the technological landscape is a constant battle. IT teams often struggle to manage the skilled personnel needed to operate cutting-edge tools. Finacle offers a powerful solution to these complex challenges. This software empowers banking institutions to streamline operations in business units, including trade finance, consumer banking and wealth management.

To wrap up

Are you ready to transform your banking operations and lead the charge into the future? With Temenos and Finacle offering powerful core banking solutions, the choice you make can set the stage for your institution’s success. Each platform brings its own unique strengths, from enhancing operational efficiency to driving customer innovation.

Temenos claims a strong market presence and years of experience. This platform is built for efficiency, empowering banks to streamline operations and boost customer service. Further, Temenos involves modern technology to boost innovation and deliver new products.

On the other hand, Finacle stands out with its cloud-based platform. This platform supports various banking functions and focuses on open banking that drives digital transformation. Finacle's focus on security and support aids in streamlining operations and accelerating innovation.

As you weigh your options, think about how these solutions align with your strategic goals and vision for growth. The right choice will not only streamline your processes but also open doors to new opportunities and drive long-term success in the competitive banking landscape. Dive in, explore, and choose the technology that will propel your bank forward into a brighter, more innovative future.

Frequently Asked Questions

1. What are the different deployment available for Finacle and Temenos?

Finacle is designed for cloud deployments, whereas Temenos provides both cloud and desktop deployment.

2. How does Temenos ensure security for banking data compared to Finacle?

Both Temenos and Finacle recognize the importance of data security in the digital banking landscape. Temenos employs security measures that include cybersecurity protocols to protect the data. While Finacle employs data privacy and control through its SaaS modules.

3. What are some of the customer offerings provided by Temenos and Finacle?

Both Temeons and Finacle offer various customer support including training programs, regular updates and support teams to benefit the core banking solutions.

4. In which countries do Finacle and Temenos have the largest number of customers?

Finacle has the highest customer base in India, followed by the United States and Nigeria. On the other hand, Temenos stands out in the United States, India and the United Kingdom.